Some Biometric system used for financial subdivision

The financial division is in the procedure of change by the new form of communication accessible in the market. Trends like fingerprint scanner are ahead of increasing power in the financial scenery, causing banks to gamble on the addition of all possible channels of the announcement to gratify the demands of the customer. The authentication of the customer and the fortification of their uniqueness are one of the most current subjects in the banking sector. It faced with security confront, banks and monetary organizations are gradually more considering the merger of biometric technology in their stand. Biometrics is stood on unique physical distinctiveness heart rate, blood distinctiveness such as stress, protein level, cholesterol, among other traits and behavioural characteristics and log in tangerine . Traditionally, fingerprint recognition has been the chosen choice in the financial subdivision. Over time, the biometric safety system is likely to replace not public identification information for ATM refuge and other situation. This change in the market is happening faster than initially anticipated, with international biometric bank revenue outlook of up to $ 4 billion by 2021.

Evaluation of the banking

The comprehensive implementation of mobile tackle with integrated biometric system permits the evolution of biometrics in the banking business. More and more smartphones and medication are prepared with biometric scanners for the confirmation process inside a mobile banking stand. From the cite one example, credit card clients can authenticate payments online by searching their fingerprints or by a selfie. In this way, users are previously set for biometric authentication in mobile depository and ATMs.

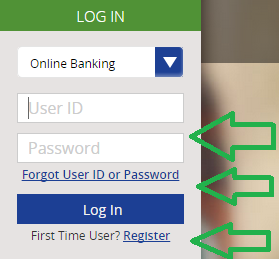

In relative to Online Banking, there is a superior use of biometric devices to incarcerate Unique Identities at the launch of the contact. It based on national identity curriculum, and banks use characteristics credentials remove from uniqueness cards to supply strong confirmation for client transactions. Also, facial biometrics is a different tool that permits the digitization of financial actions. Through it, users can authenticate their individuality and conduct banking contact online. It is an explanation that is straightforward to implement and use, both for the bank and for the mobile banking user, facilitate the consumer to have secure contact to the system from a central processing unit or smartphone or with a video camera.

The implementation of mobile banking is flourishing in the country, while fingerprint biometric classification at ATMs is still in an just beginning stage. Banks are digitizing their operations gradually and respond to the requirements of users, who assistance from not have to memorize immeasurable passwords to be intelligent to carry out banking contact. The biometric solutions symbolize, then, a turning point for the refuge of the banks. In the economics industry, realize the biometric authentication technique is critical to construction trust in clients and raising the level of fortification in banking contact. The adoption of biometric knowledge by banks augment the end-user practice and helps to resist fraud and uniqueness abuse. One enormous way of making our money work for us better is to decide to invest it in a high acquiesce account. People find out which bank present you and the best rates, and we might want to meet with a client service professional who will clarify the statement to us.