Banking security and safety measures

Everyone benefits from online banking at present days. Most people use online banking for every transaction. It is more beneficial and offers for people during transactions. No one can blame us for being wary and suspicious. After all, it is our money we are discussing it. We have heard of reports and stories on TV about e-thieves robbery important in sequence like credit card numbers. The reality is, online banking is just as locked as our ordinary people to people banking and is more protected than the media frequently makes it out to be. Online banking might be safer than traditional banking in it.

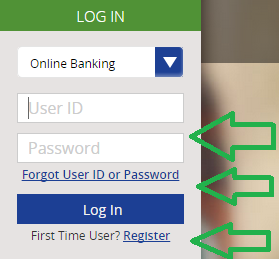

We might not have apprehended it, but in traditional tangerine banking log in we are bare to several security threats. Our mail surrounds our bills, and bank announcements can be intercepted. When we use the ATM, we may be uncovered to physical theft or in sequence theft. Our information can also be an admission by bank employees. Above all, when we disburse our bills with a verify, our account number, social sanctuary digit, and even our phone number are typically printed on the paper verify. These threats can be keep away from, if not eliminated, with online banking. Some Financial transactions are completed in the soothing and security of our house or office. Moreover, because they are familiar with that online customers are worried, safety is their top worry. A firewall also cossets the bank’s computers.

Security Measures

Although single secret word protection is the most frequent security technique in the United States, password confirmation alone is not secure enough for information and business with Internet banking. That’s why online banks use a far more complicated system to guard their clients and, eventually, themselves. They employ frequent layers of approach and measures to ensure their customers of the sanctuary of their dealings. These approaches vary according to the alternative of the bank. Yet, some estimates are frequently employed by many online banks. Here are some of them.

Most online banks receive customer’s refuge to another level with business numbers or TANS. This method is the most accepted among online banks. These TANs are passwords that are proposed for a single meeting only. It important banks using this approach include the Deutsche Bank.

Protection Tokens

Some banks subject security tokens to the clients. These tokens energetically change the numbers clients need to enter for each deal. Online banks using this system include the Bank of Ireland, the Commonwealth Bank of Australia, the nationwide Bank of Dubai, the Bank of Queensland, and the Montgomery Bank.

Digital documentation

Another technique of ensuring online banking defense is with the digital record. These virtual certificates permit us to digitally validate our transactions between them to a physical device such as a private computer and a mobile phone. Digital certificates are being used in massive banking corporations such as Barclays, HSBC, the China Merchants reservoir, the Bank of Montreal, the West Bank, and many others.

Online banks or Internet banks have their security policies and procedures posted on their sites prominently. You can browse through them before choosing which bank to trust. If you have further questions about their methods, send them a message, and they will respond to it appropriately.